closed end loan trigger terms

If an advertisement promoting closed-end credit for real estate contains any of the following trigger terms the three specific disclosures listed at the bottom of this page must also be included in the advertisement. For example if an advertisement for credit secured by a dwelling offers 300000 of credit with a 30-year loan term for a payment of 600 per month for the first six months increasing to 1500 per month after month six followed by a balloon payment of 30000 at the end of the loan term the advertisement must disclose the amount and time.

Credit sales only ii The number of payments or period of repayment.

. Regulation Z is structured accordingly. The amount of the down payment expressed either as a percentage or as a dollar amount. Application of the Rules.

Iv The amount of any finance charge. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a specific date. Triggering terms are defined by the Truth in Lending Act TILA and are designed to protect consumers from predatory lending practices.

Stating the amount of down payment and the APR is easy. Item Description Yes No NA. However the APR is a triggering term for open-end credit.

For instance a few terms for closed end credit that trigger the need for additional disclosure are. 102624b opens new windowNote. Triggering terms for closed-end loans.

The APR is not a trigger if its a closed-end loan. A triggering term is a word or phrase that legally requires one or more disclosures when used in advertising. Subpart A sections 10261 through 10264 of the regulation provides general information that applies to open-end and closed-end credit.

A trigger term is used when advertising what type of credit plan. Different sets of triggering terms apply to closed-end credit products such as mortgages and open. For instance a few terms for closed end credit that trigger the need for additional disclosure are.

The Credit Union will comply with the Truth-in-Lending Act and its implementing regulation Regulation Z by providing consumer borrowers with proper Truth-in-Lending disclosures for closed-end credit in a timely manner. Subpart AProvides general information that applies to both open-end and closed-end credit transactions including definitions explanations. Up to 48 months to pay 90 percent financing As low as 50 a.

Iii The annual percentage rate using that term and if the rate may be increased after consummation that fact. Iii The amount of any payment. Residential mortgage transactions demand loans and installment credit contracts including direct loans by banks and purchased dealer paper are included in the closed-end credit category.

Credit such as credit cards or home-equity lines or closed-end credit such as car loans or mortgages. If any of the following terms is set forth in an advertisement the advertisement must include the additional disclosures described in D2. Ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages.

Does the institution make all required disclosures clearly and conspicuously. There are triggering terms associated with different loan products such as home equity credit lines closed end credit HELOCs and many other loan products. Except for home equity plans subject to 102640 in which the agreement provides for a.

Unfortunately noif during the loan term a HELOC is converted from open-end credit to closed-end credit that would trigger closed-end credit requirements including the TRID disclosures as set out here. Section 102635 prohibits specific acts and practices in connection with closed-end higher-priced mortgage loans as defined in 102635a. Finance Charge Accrual Timing.

Truth-in-Lending Disclosures for Closed-End Credit Revised Date. Refer to Section 22624 for closed-end advertising requirements and Section 22616 for open-end advertising. The number of payments or period of repayment such as 48-month payment term or 30-year mortgage this is often the most overlooked triggering term The amount of any payment 550 per month The amount of any finance charge 500 origination fee 2 points.

If this is a variable rate loan the Loan Amount section as set forth in the Closed End Loan. I The amount or percentage of any downpayment. Of this section that trigger the imposition of the rate increase.

Trigger terms when advertising a closed-end loan include. HOEPA Points and Fees Calculation A bona fide discount point for closed-end loans is 1 of the loan amount paid by the borrower that reduces the interest rate for the transactionFor open-end loans it is 1 of the plans credit limit when the account is opened paid by the borrower and reduces the interest rate. A membership fee is not a triggering term nor need it be disclosed under 102616b1iii if it is required for participation in the plan whether or not an open-end credit feature is.

Institutions may provide disclosures required by 102624 opens new window to the consumer in electronic form without regard to consumer consent or other provisions of the E-Sign Act in. If more than one interest rate will apply. Subpart C 22617 through 22624 includes provisions for closed-end credit.

The periodic rate used to compute the finance charge or the annual percentage rate. Section 102616b applies even if the triggering term is not stated explicitly but may be readily determined from the advertisement. 12202013 General Policy Statement.

Converting open-end to closed-end credit. In the event a financial institution furnishes negative information to a credit bureau for use on a consumers report which of. Missing additional disclosures on auto loans 1 Triggering terms.

Closed-End Auto Loan Ads. The triggering terms are. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a specific date.

Change-in-terms and increased penalty rate summary for open-end. Ii The terms of repayment which reflect the repayment obligations over the full term of the loan including any balloon payment. The APR is not a trigger if its a closed-end loan.

12202013 General Policy Statement.

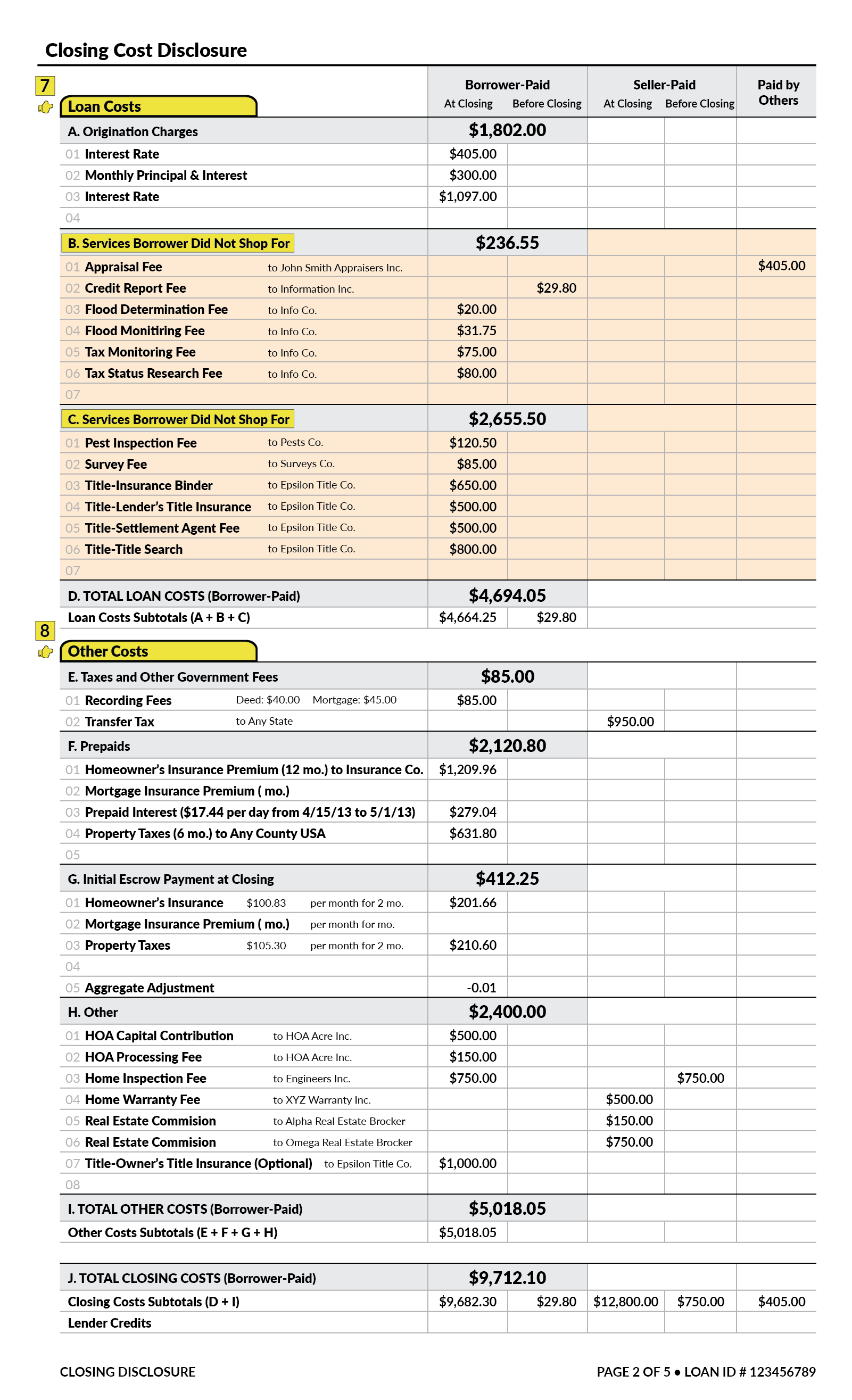

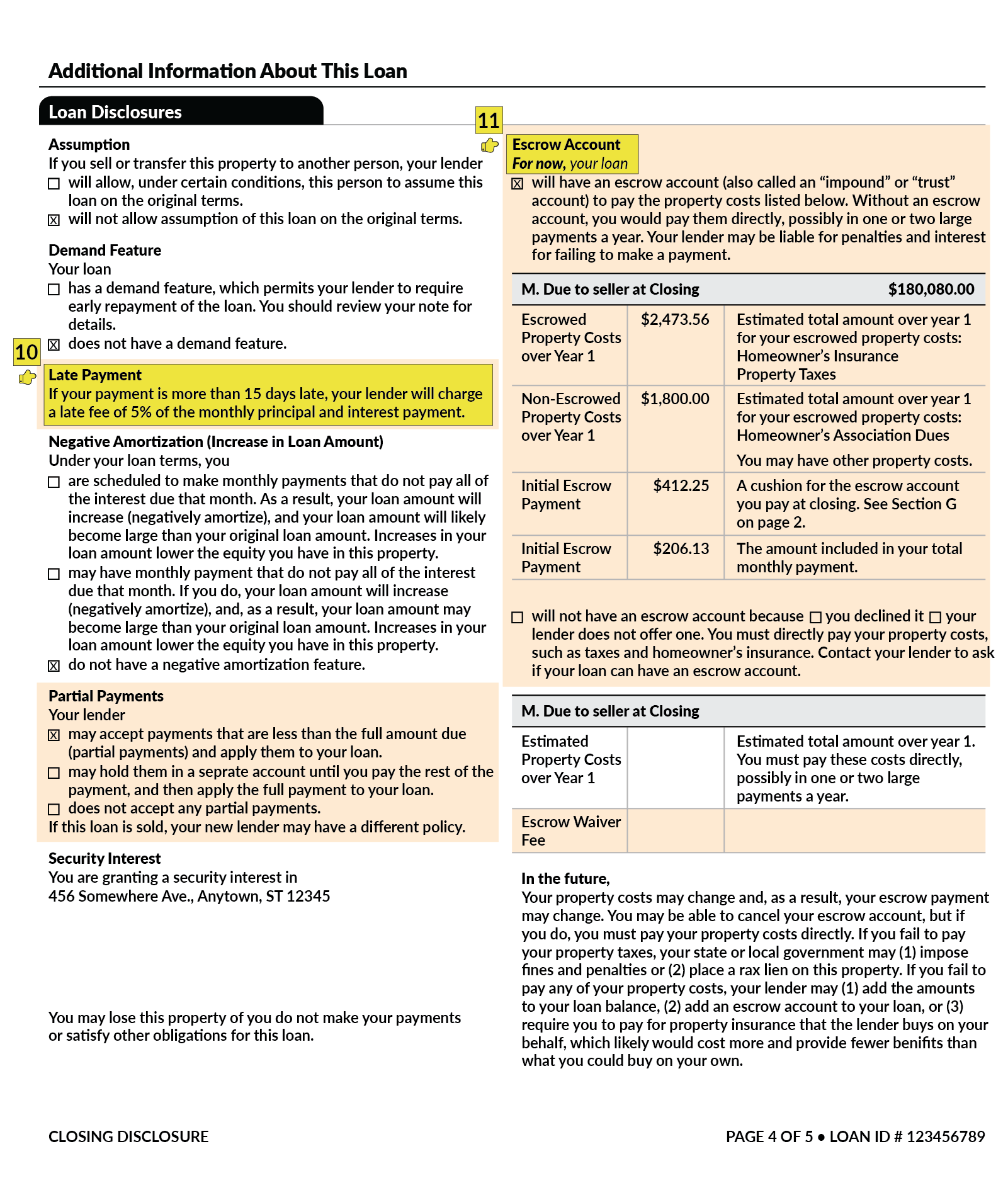

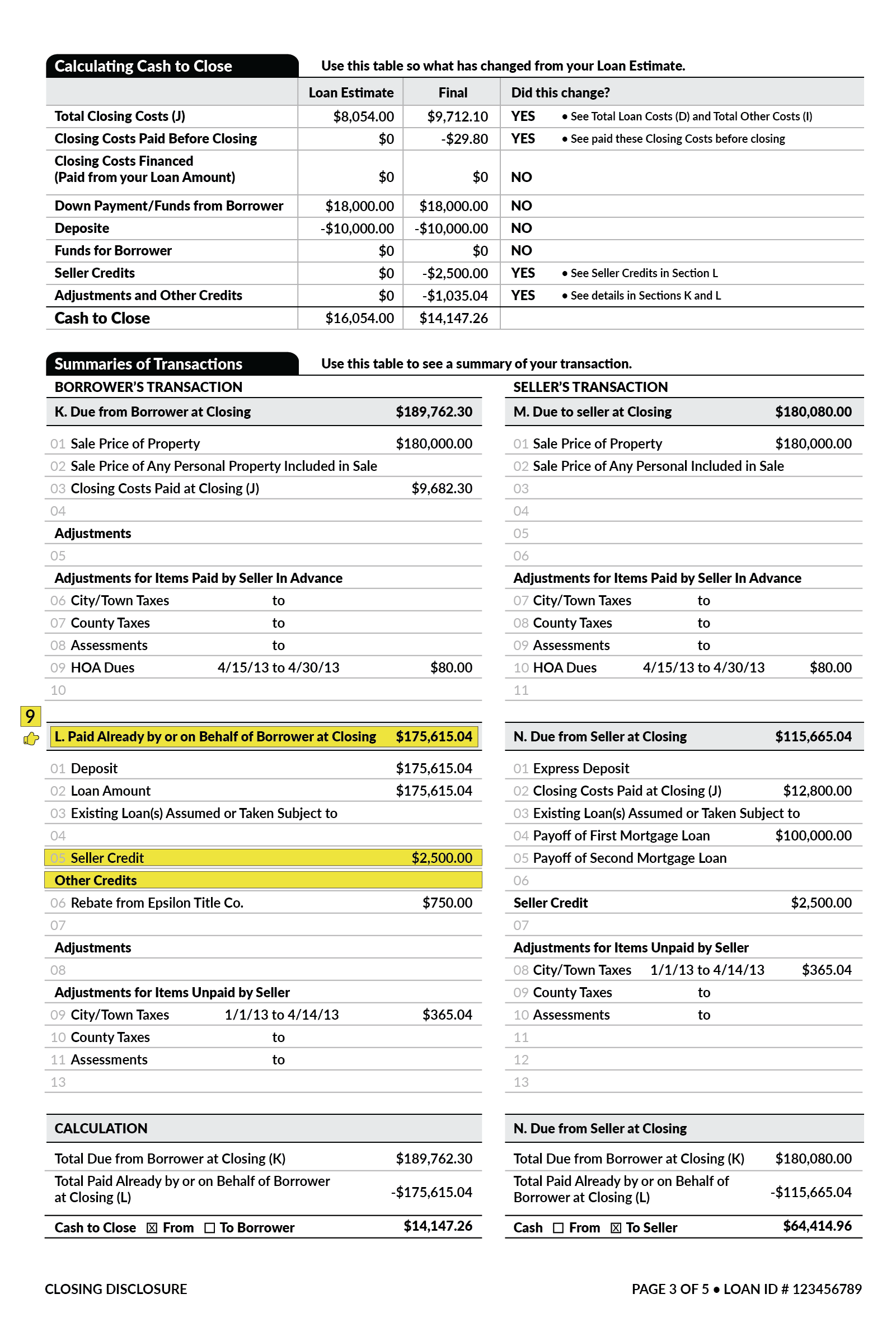

What Is A Closing Disclosure Lendingtree

Federal Register Regulation Z Truth In Lending

Federal Register Regulation Z Truth In Lending

What Is A Closing Disclosure Lendingtree

Federal Register Regulation Z Truth In Lending

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

Truth In Lending Act Tila Consumer Rights Protections

Federal Register Regulation Z Truth In Lending

Federal Register Truth In Lending Regulation Z

Federal Register Truth In Lending Regulation Z

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-597314925-72053ed3e7d54bcca2b40d3d84937d67.jpg)

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)